For innovators in Canada, investments in research and development (R&D) are vital; however, funding innovation often proves challenging, especially for growing companies with limited resources.

The Canadian and Provincial Governments have several programs to help propel investment in R&D in companies across the country. Among them are the Canada Revenue Agency’s Scientific Research and Experimental Development (SR&ED) tax credit and Revenu Quebec’s Tax Credit for the Development of E-Business (TCBE), often referred to as “CDAE,” its French-language abbreviation.

We will explore the key similarities and differences between the two programs available to companies operating in Quebec so that you can get a better idea of whether the programs are the right fit for your company. Keep in mind that CDAE and SR&ED are not necessarily mutually exclusive—we will explore this later.

Nature of funding

Both the SR&ED and CDAE programs are tax credits.

A tax credit is an amount of money that a company can subtract from the taxes they owe the CRA and their provincial agency or it can be a direct refund regardless of taxes paid or owing.

In the case of a refundable tax credit, a company will receive a cash reimbursement at the end of the year, deducting any taxes due. Meanwhile, non-refundable tax credits are capped at the company’s tax liability—even if the credit exceeds the owed taxes, the company will not receive any additional reimbursements and the full value of the credit will not be used. Having said that, non-refundable tax credits can often be carried forward or back.

SR&ED is generally a refundable tax credit for Canadian-controlled Private Corporations (CCPCs). When claimed by non-CCPCs, the program offers a non-refundable tax credit. On the other hand, CDAE offers a combination of refundable and non-refundable tax credits.

Eligibility Criteria

Eligible Companies

Most significantly, SR&ED supports companies across Canada, while CDAE only offers credits to companies in Quebec.

The CDAE requires that eligible companies be focused on developing and selling software licenses or services. Your company’s gross revenue must be at least 75% derived from IT sector activities; 50% of these activities must be related to a core subset of the IT sector, as defined here.

Additionally, to qualify for CDAE credits, your company must have at least 6 full-time, eligible technical employees for the entire fiscal year of the claim.

This minimum requirement is more flexible for startups that have existed for less than 2 years. For these companies, they will meet the eligibility criteria once they reach 6 eligible technical employees in the fiscal year.

The SR&ED credit does not have revenue requirements, nor does it require a minimum number of employees.

Beyond the eligibility of the company, there is a second level of eligibility for CDAE: the eligibility of employees and their salaries.

Eligible Activities

SR&ED supports R&D activities in any industry. R&D activities must demonstrate a systematic approach, an attempt at technological advancement, and technological uncertainty. As such, projects related to technology that have already been validated and for which there is readily accessible information cannot be claimed.

Contrarily, the CDAE covers activities in E-business, SaaS, and B2B software companies. While CDAE’s revenue requirements are more restrictive, its eligible activities are less rigid and can include routine development.

It is important to note that CDAE does not cover programs that involve software that controls hardware or is built into hardware. As such, projects in the IoT or robotics are essentially ineligible because they involve software that controls mechanical elements.

Additionally, projects that rely on external data sets, such as AI or AI-adjacent projects, are ineligible for CDAE as well. To be eligible, data used in the project must be internally owned and generated by your clients.

Interested in learning more about SR&ED Eligibility? Read our guide here.

Eligible Expenses and Amounts

Both tax credits cover salaries; however, they have different requirements and credit amounts.

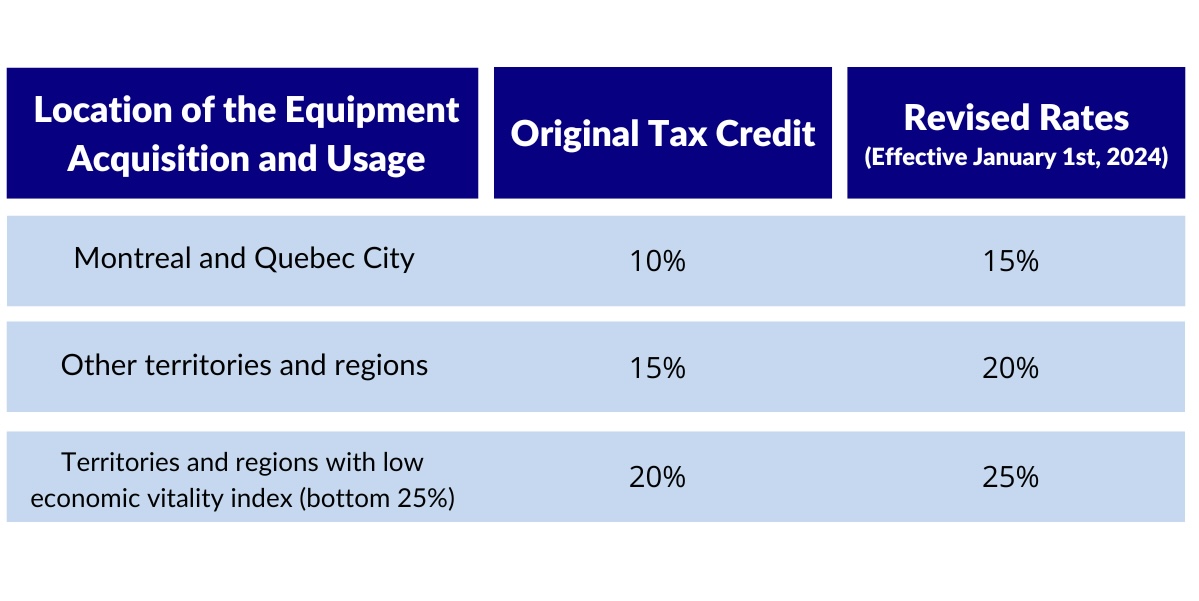

CDAE covers only the salary of employees in technical roles across the product development life cycle – including developers and QA. The CDAE offers a refundable tax credit of up to 24% and a non-refundable tax credit of up to 6% of each eligible employee’s salary. These credits are applied to the total salary, regardless of the portion that is directly related to the CDAE activities.

Note, however, that the CDAE only covers salaries up to $83,333, meaning that companies can only receive up to $20,000 in refundable credit and up to $5,000 in a non-refundable credit per employee salary. There are no restrictions on the number of employees that can be covered by CDAE; however, a fee must be paid to Invest Quebec for the annual eligibility certificates requested and this fee varies based on the number of employees claimed.

Unlike CDAE, companies applying to SR&ED can only claim tax credits on expenses such as salaries, wages, materials consumed or transformed, subcontractor expenses, and overhead.

The SR&ED tax credit covers only the portion of employee salaries and subcontractor expenses that are related to eligible R&D activities in Canada. In other words, the SR&ED refundable tax credit is based on the percentage of time spent on R&D activities relative to the employee’s salary. However, there is a tradeoff: this program also covers the salaries and wages of support employees, such as HR or payroll employees who specifically spend time recruiting engineers for the SR&ED project or handling payroll for project employees. This is known as indirect SR&ED and is claimed in different manners federal and provincially.

Note that, unlike CDAE, SR&ED tax credits are not restricted by a maximum eligible salary amount for non-owners.

Application Process

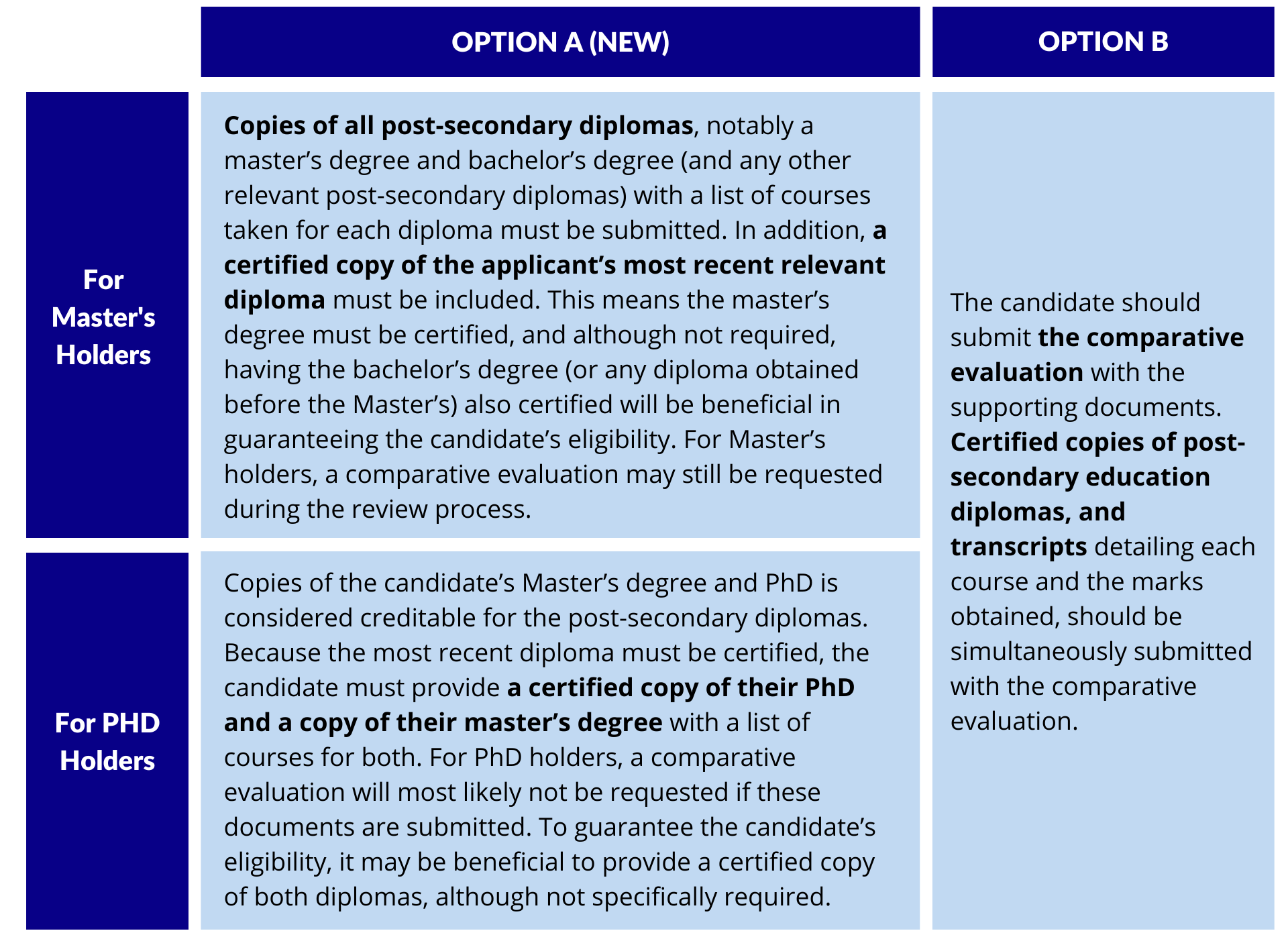

The CDAE’s application process is done in two levels: first, you must apply to Invest Quebec within 15 months of the fiscal year-end in which the expenses were incurred to receive an eligibility certificate confirming eligibility of the company and for all employees for which a tax credit is being requested. These CDAE applications automatically get reviewed—the process is standardized and systematic. Then, you must submit an application to Revenue Quebec (RQ) within 18 months of the same fiscal year.

Meanwhile, SR&ED tax credit must be claimed within 18 months of the fiscal year within the tax return to CRA and RQ and do not always get audited, but you can expect at least a first-year visit by the CRA.

SR&ED vs CDAE

So, we’ve discussed the two programs and their differences. Now, which one will be more beneficial to your business?

CDAE can help companies that are more advanced and are looking to scale up. Many companies receive more SR&ED tax credits in the early days of their innovation projects and then move towards increasing their CDAE funding amounts as SR&ED covers fewer of their activities.

Because routine development activities are covered under CDAE, businesses that are looking to maintain or improve existing technology will benefit. Meanwhile, these activities are not covered under SR&ED.

CDAE is also more beneficial to large or foreign companies since its tax credits are fixed regardless of size or ownership structure, unlike SR&ED which offers lower, non-refundable credits to non-CCPC and larger companies.

Stacking SR&ED and CDAE

If both programs seem like they’d benefit your business, how do you choose which one to claim? There’s good news: it is possible to claim both SR&ED and CDAE.

A few options exist if you want to benefit from both programs. Claiming federal SR&ED tax credits and provincial CDAE tax credits is a great combination. It is also possible to optimize both CDAE and SR&ED on the provincial level to maximize the tax credit amount, but this is tricky.

If you like to learn more about how to stack SR&ED and CDAE or need some help, speak with our experts to find the best option for your company’s specific needs.

Still Have Questions?

Read what our experts have to say in our SR&ED FAQ and CDAE FAQ articles.

If you’re considering submitting a CDAE claim or combining credits, don’t hesitate to contact R&D Partners at 1-800-500-7733 for more information or to schedule a meeting with one of our expert consultants.

Disclaimer: The views expressed in this article are provided for informational purposes only. It is not intended to nor can it replace the evaluation of your specific SR&ED or e-business tax credit claim by a dedicated professional.