Overview of Quebec’s C3i Tax Credit for Investment and Innovation

The Quebec provincial government first introduced the Tax Credit for Investment and Innovation – or C3i for short – in its March 2020 budget. It was initially intended as a replacement for prior investment and innovation tax credits, with more advantageous rates and broader eligibility.

This article offers an overview of the tax credit’s criteria, reimbursement rates and other relevant details. It will also examine the changes the 2021-2 Budget introduced to the tax credit in response to the COVID-19 pandemic to further support economic revitalization and recovery.

Company Eligibility

The C3i tax credit is not restricted by industry – with a few notable exceptions we will touch on later. Its first stated goal is to encourage the purchase of manufacturing and processing equipment. It can also be used to purchase enterprise resource management software packages – ERP for short – and computers. The broader goal is to help Quebec businesses digitize their operations and modernize their equipment, and accelerate these investment projects by reducing the financial burden on the corporations that undertake them.

Quebec “qualified corporations” – that is corporations carrying business and with an establishment in the province – are eligible for this credit. A few exceptions apply to certain aluminum producers and oil companies. Additionally, certain businesses engaged in partnerships that operate aluminum production sites or oil refineries may not qualify either.

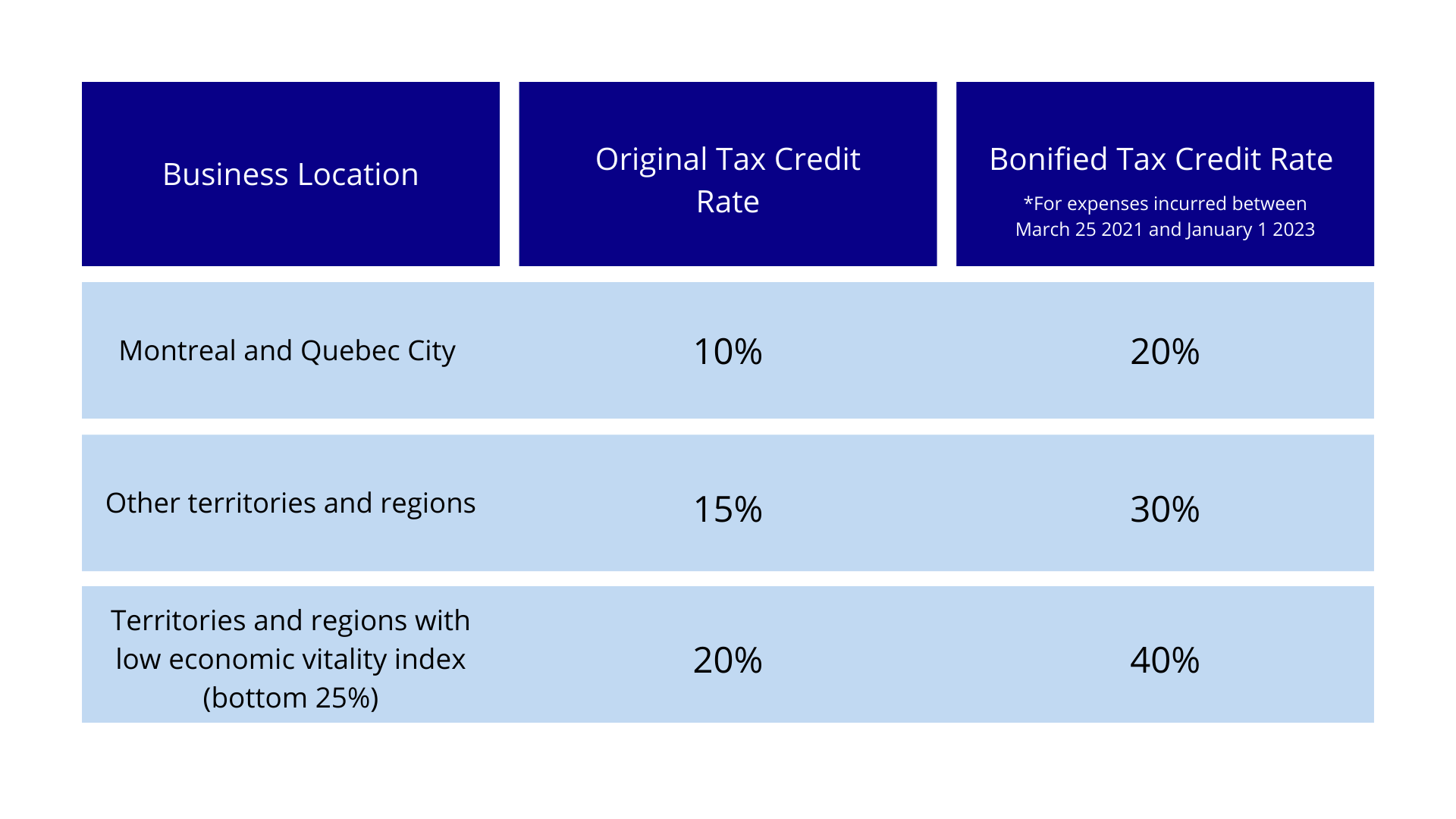

All businesses in Quebec are eligible regardless of location, but the economic vitality index for each region affects tax credit rates under this program. This means that businesses in more economically developed areas will have lower tax credit rates, and those in economically underdeveloped areas will have higher tax credit rates. We will examine these different rates in detail below.

Tax Credit Rates

Businesses with assets and gross income below $50 million can benefit from a fully refundable tax credit. Those with assets and gross income exceeding $100 million are instead eligible for a non-refundable tax credit. Finally, the C3i tax credit is partially refundable for businesses that fall in between the $50 and $100 million thresholds.

As mentioned earlier, businesses located in areas considered to have “low economic vitality” are eligible for higher tax credit rates. Those areas are those with an economic vitality index amongst the lowest 25% in the province. The complete list of regions eligible for the highest tax credit rate, as well as a map showing the original tax credit rate for each administrative region of Quebec can be found in section C-42-43 of Budget 2020. Three new territories can also qualify as having low economic vitality for eligible purchases made after June 2021: Le Domaine-du-Roy, Maskinongé and Papineau.

It is important to note the difference between the original tax credit rates that came with the tax credit’s original 2020 Budget announcement, and the temporarily bonified rates announced in the 2021 budget in response to the COVID-19 pandemic. The bonified rate is simply double the original rate.

All eligible equipment purchased outside of the bonified tax credit rate period (March 25, 2021 to January 1, 2023 exclusively) will still be eligible for the tax credit at its original non–bonified rates – as long as it is purchased before January 1, 2025, the current final end date for this tax credit. At the time of publication, eligible businesses have a little bit less than a year to purchase equipment and software that will qualify for the bonified rates.

Expenses

All eligible equipment must have been purchased after March 2020, but before January 2025 in order to qualify for the tax credit.

However, two exclusion thresholds apply. For manufacturing and processing equipment, only expenses in excess of $12,500 are eligible for the tax credit. A lower minimum $5,000 expense threshold applies to computer hardware and management software packages purchases.

Businesses claiming the C3i credit are also subject to an overall $100,000 cap on eligible expenses over five years.

C3i’s Interaction with Other Tax Credits

First, the new C3i fully replaces the tax credit for the integration of IT in SMBs. This older tax credit was retired because ERP software packages are covered under the C3i. Expenses incurred on or after January 1st, 2021, are no longer eligible for the integration of IT in SMBs tax credit.

The other tax credit that the C3i partially or fully replaces, depending on a business’s situation, is the tax credit for investments relating to manufacturing and processing equipment – ITC for short. Unlike the tax credit for the integration of IT in SMBs, however, the ITC tax credit remains available to businesses in specific resource regions at rates ranging from 4% to 24%. The businesses that are still eligible for the ITC will have the choice to continue using that tax credit for the time being or switch over to the new C3i credit. Businesses that are eligible for both will need to examine their specific circumstances and identify which credit maximizes their government funding.

To find the C3i tax credit on our free, AI-powered funding search engine, click here.

How R&D Partners can help

If you have any questions about this or other tax credit programs, do not hesitate to contact Dominik Klein at dklein@rdpartners.com, or at 1-800-500-7733 ext. 103.

Further Reading:

This article is intended for general informational purposes only and does not constitute professional accounting or tax advice.