Changes to the C3i Tax Credit: Fostering Business Investment and Innovation

In the Fall 2023 Budget Update, the Quebec government announced an investment of $1.3B into the Investment and Innovation Tax Credit (C3i), extending its support for businesses for another five years until January 1, 2030. Initially introduced in the March 2020 budget to replace prior investment and innovation tax credits, the C3i tax credit aims to boost productivity in Quebec businesses while encouraging increased investments in economically disadvantaged areas.

Alongside the 5-year extension, several modifications have been announced to better serve the needs of Quebec businesses and bolster their efforts to improve productivity. This article will explore these changes.

Eligible Businesses and Expenses

The C3i tax credit remains accessible to businesses across diverse industries, with certain exceptions such as aluminum producers and oil companies. Eligible businesses, which are investing in equipment to improve their processes and increase productivity, can benefit from the C3i tax credit. This includes Quebec businesses that acquire manufacturing or processing equipment, general-purpose electronic data processing equipment, or eligible management software packages between March 10, 2020 and January 1, 2030.

As before, two exclusion thresholds apply. For manufacturing and processing equipment, only expenses over $12,500 are eligible for the tax credit. For the purchase of computer hardware and management software packages, a lower minimum, $5,000, applies.

Businesses claiming the C3i credit are also subject to a cumulative $100 million limit on eligible expenses over four years—an update compared to the previous five-year period.

Enhancement of Tax Credit Rates

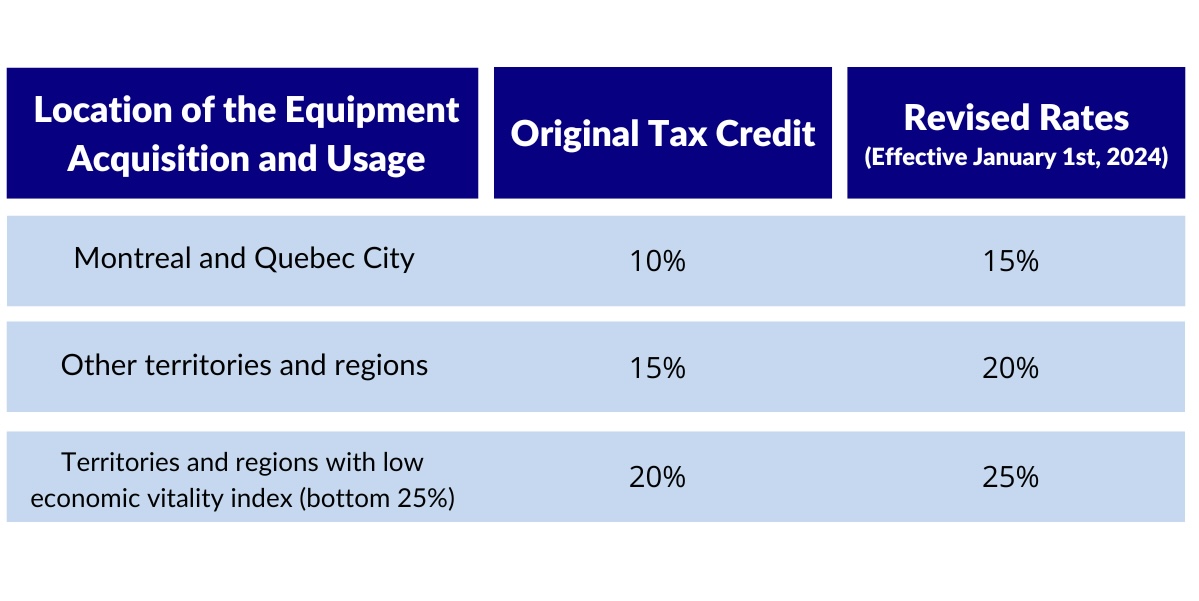

The improvements to the tax credit rates are perhaps the most prominent change announced. C3i rates have increased by 5%, across all regions of Quebec. The tax credit rates vary depending on the location of the business, offering higher rates to businesses operating in areas deemed to have “low economic vitality”. These regions have been assigned an economic vitality index amongst the lowest 25% in the province.

As announced in the Information Bulletin 2023-4, RCM Appalaches and Témiscamingue are now included in the lowest quartile, while RCM Matawinie and Argenteuil are no longer included. These regional changes will apply to expenses incurred after June 30, 2025, ensuring a proper transition period for affected businesses. Consult the latest Regional Economic Vitality Index for the classification of regions across Quebec.

Below are the new rates for the regions across Quebec, applicable beginning January 1, 2024:

These new rates apply to eligible expenses incurred after December 31, 2023; or after March 25, 2021, and before January 1, 2024, for equipment acquired after December 31, 2023.

Please note, however, that some exceptions apply. Please consult Information Bulletin 2023-6 for more details.

Fully Refundable Tax Credit

Before the amendments to the C3i, the ability to receive a refundable tax credit was dependent on the businesses’ assets and gross income. Only businesses with assets and gross income below $50 million were eligible for a fully refundable tax credit.

However, in the recent budget update, requirements related to assets and gross income were removed. Now, all eligible companies can fully benefit from the refundable nature of the Investment and Innovation Tax Credit regardless of their assets or gross income.

Final Thoughts

The recent changes to the C3i Tax Credit represent a step forward in supporting Quebec businesses and fostering innovation and investment across the province. With the extension of the tax credit until 2029, increased rates, and various improvements, businesses, especially those in regions with low economic vitality, now have greater incentives and opportunities to improve productivity and expand their operations.

As businesses continue to navigate challenges and seize opportunities, the C3i Tax Credit stands as a valuable tool for driving progress and success in Quebec’s evolving economy.