Hire Smarter: Three Steps to Building a Cost-Effective Hiring Strategy

Dec 9, 2025

Hiring students is not just a way to bring fresh ideas and energy into your organization, it can also be a major funding opportunity. Across Canada, employers can often stack the federal Student Work Placement Program (SWPP) with provincial tax credits to significantly reduce hiring costs while giving students valuable, career-building experience. In this guide, we’ll walk through the key steps to building a smart student hiring funding strategy.

Step 1: Start with the Federal SWPP

The Student Work Placement Program (SWPP) provides wage subsidies for Canadian businesses and non-profits that hire post-secondary students for work-integrated learning placements.

Funding Overview:

Subsidizes 50% of wages (up to a maximum of $5,000) or 70% (up to a maximum of $7,000) for students from underrepresented groups

Eligible expenses include both student and supervisors’ wages

Eligibility

Eligible applicants are Canadian businesses or non-profits

Students hired must be Canadian citizens, permanent residents, or protected persons

Positions must align with the program’s focus areas

Application Timeline

Apply before the placement start date through one of the SWPP’s delivery partners

Fall term placement applications open late summer

Winter term placement applications open in late fall

Summer term placement applications open early spring

Funding is limited and may close early

Funding for the Student Work Placement Program is delivered through a network of trusted partners across Canada. These include organizations such as ICTC WIL Digital, BioTalent Canada, Magnet, TECHNATION, The Canadian Council for Aviation & Aerospace, ECO Canada, Electricity Human Resources Canada, the Mining Industry Human Resources Council, Venture for Canada, the Excellence in Manufacturing Consortium, the Ontario Chamber of Commerce, Tourism HR Canada, Culture Works Canada, Trucking HR Canada, the Canadian Agricultural Human Resource Council, Food Processing Skills Canada, the Canadian Media Producers Association, and Pratiques RH.

Step 2: Add Provincial Tax Credits

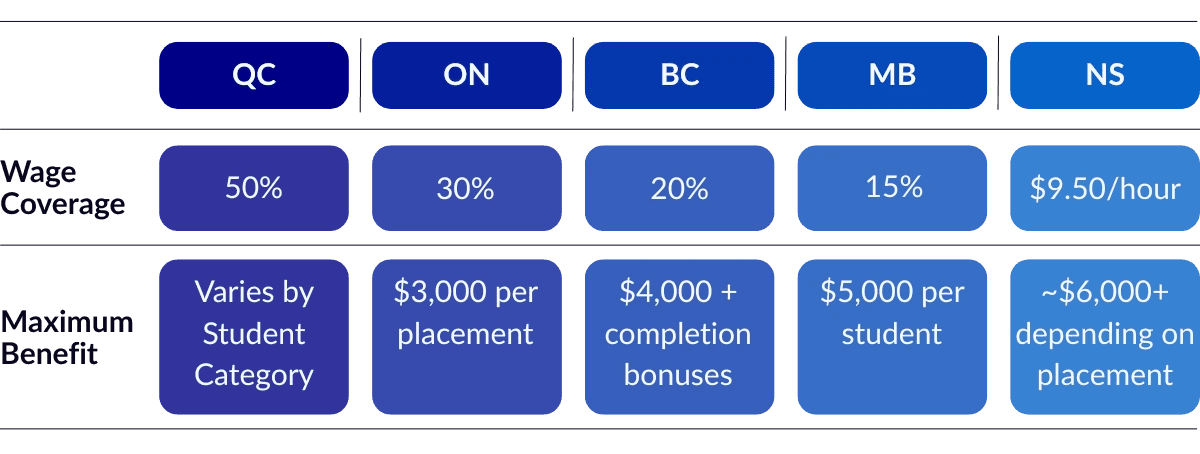

Stacking SWPP with provincial programs can substantially cut hiring costs, in some cases covering the majority of a student’s wages. These incentives are designed to strengthen local talent pipelines and reward businesses for investing in the next generation, making them a smart complement for federal support. In Québec, Ontario, British Columbia, Manitoba, and Nova Scotia, employers can access additional programs that combine with SWPP to provide even greater savings.

Québec - Tax Credit for an On-the-Job Training Period

Québec offers one of the most generous co-op tax credits in Canada, covering not only student wages but also supervision costs.

Funding Overview

Tax credit of up to 50% of eligible wages and supervision costs

In the first two years, the rate is 24%

Weekly maximums apply depending on the student’s category (e.g., secondary, CEGEP, or university student)

Eligibility

Employers must have a permanent establishment in Québec

Students must be:

Enrolled in a recognized co-op program at a secondary school, CEGEP, or university

Working for at least 140 hours

Employers must obtain an official “Attestation of participation” from the educational institution

Ontario – Co-operative Education Tax Credit

Ontario’s program is one of the most widely used, offering a simple way for employers to offset co-op wages while giving students valuable work-integrated learning experiences.

Funding Overview

Refundable tax credit covering 25% of eligible wages (or 30% for small businesses)

Up to $3,000 per student placement

Placement must be a minimum of 10 consecutive weeks

Eligibility

Employers must have a permanent establishment in Ontario

Students must be enrolled in a recognized post-secondary co-op program

Must have certification from the educational institution confirming eligibility

British Columbia – Training Tax Credit

British Columbia supports employers who take on apprentices through the SkilledTradesBC system. This credit not only helps offset wages during training but also rewards employers when apprentices complete key levels of their program.

Funding Overview

Refundable tax credit for employers hiring apprentices in SkilledTradesBC programs

20% of wages in the first 24 months (up to $4,000 per apprentice)

Additional completion credits are available:

15% (max $2,500) for Level 3 completion.

15% (max $3,000) for Level 4 completion.

Enhanced credits are available for Fist Nations apprentices and persons with disabilities

Eligibility

Employers must have a permanent establishment in British Columbia

Apprentices must be registered in an eligible SkilledTradesBC program

Manitoba – Paid Work Experience Tax Credits

Manitoba’s program supports both co-op placements and graduate employment, making it one of the most versatile hiring incentives in Canada

Funding Overview

Refundable tax credit for hiring post-secondary co-op students and recent graduates

Co-op Student Placement: 15% of wages (max $5,000 per student)

Graduate Employment: 15% of wages in each of the first two years post-graduation (max $2,500 per year)

Eligibility

Employers must have a permanent establishment in Manitoba

Students must be either:

Enrolled in a recognized co-op program, or

Recently graduated from one

Nova Scotia – Co-operative Education Incentive

Nova Scotia reduces hiring barriers with a direct hourly wage subsidy, encouraging more employers to create co-op placements for post-secondary students.

Funding Overview

Wage subsidy for 12–16-week work terms

Covers $8/hour, or $9.50/hour for students from designated diversity groups

Can support up to 640 hours of work per placement

Eligibility

Employers must have a permanent establishment in Nova Scotia

Students must:

Be enrolled in a recognized co-op program at a Nova Scotia university or college

Complete a minimum of 390 hours of work during the term

Application Notes

Provincial tax credits are typically claimed through your corporate income tax return using the appropriate forms and schedules for each province. In contrast, direct co-op incentive program like Nova Scotia’s require employers to apply during institution-specific intake periods that align with academic terms. Be sure to track both your placement details and required documentation in advance so you can file on time and maximize your eligibility.

Step 3: Develop You Workforce Efficiently

Hiring students is a win-win: employers get motivated workers, test-out potential future full-time hires, strengthens relationships with educational institutions, and supports workforce diversity and future skills development, while students gain experience that prepares them for future careers. With the right funding strategy, you can maximize these benefits and reduce your costs at the same time. Our team can help you navigate programs like SWPP and provincial tax credits to create a tailored approach that works for your business.

Contact us today to get started.